Qualcomm (NASDAQ: QCOM) is scheduled to report its Q1 FY2025 earnings tomorrow after market close. While the company has demonstrated strong performance in several areas, it also faces challenges that could impact its earnings and forward guidance. Below is a summary of the positive and negative factors influencing Qualcomm's outlook:

📈 Positive Factors

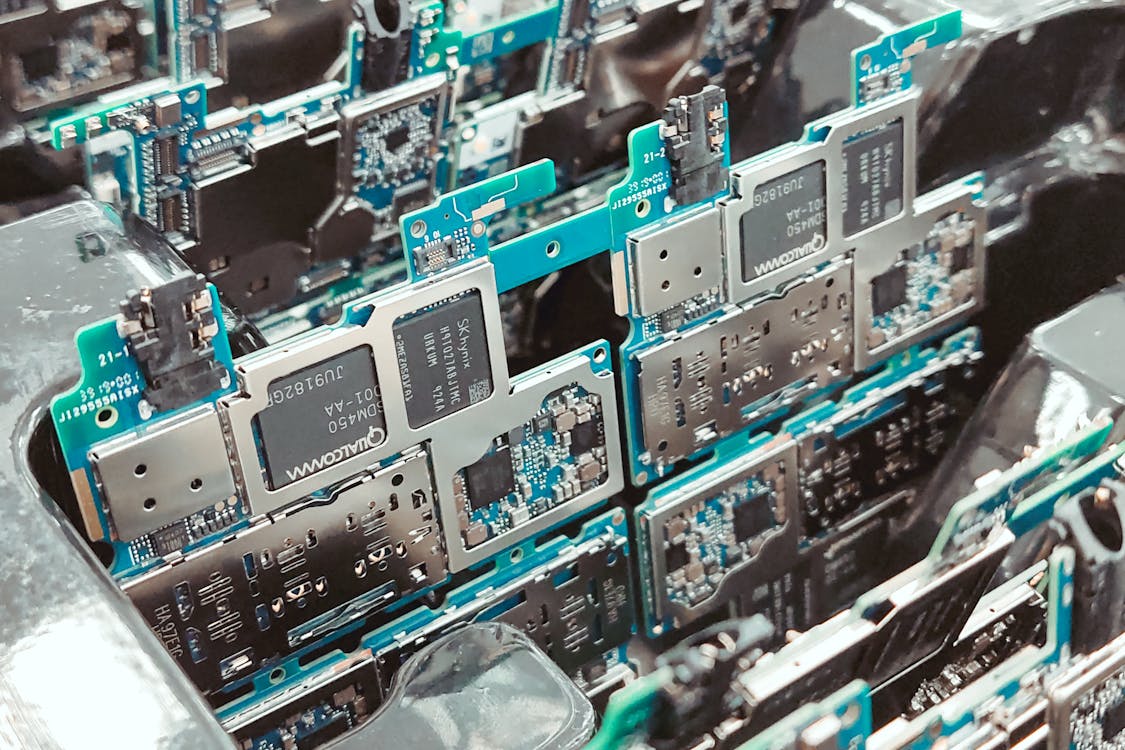

- Robust Q1 Performance: Qualcomm reported Q1 revenue of $11.67 billion, an 18% year-over-year increase, and net profit of $3.18 billion, surpassing analyst expectations. The semiconductor (QCT) segment saw a 20% revenue increase, with notable growth in mobile (13%), automotive (60%), and IoT (36%) sectors. GuruFocus

- Automotive Segment Growth: The automotive division achieved record revenue of $961 million, a 61% year-over-year increase, marking the sixth consecutive quarter of record performance. This growth is driven by partnerships with major automakers and the deployment of high-performance, low-power computing chips. The Motley Fool

- Expansion in China: Qualcomm has benefited from increased demand for premium smartphones in China, aided by government subsidies. This has led to a 40% sequential revenue increase from Chinese OEMs, offsetting weaknesses in lower-end models. AI Invest

- Advancements in AI and PC Markets: The company is making strides in AI-enabled PCs with its Snapdragon X Elite chips, which power Microsoft's latest Surface laptops. Qualcomm projects $4 billion in PC revenue by FY2029, capitalizing on the shift toward Arm-native compatibility in Windows 11. AI Invest

- Shareholder Returns: In Q1, Qualcomm returned $2.7 billion to shareholders through $1.8 billion in stock repurchases and $942 million in dividends, demonstrating strong cash flow and commitment to shareholder value. The Motley Fool

📉 Negative Factors

- Apple's Transition to In-House Modems: Apple's move to develop its own modem chips, starting with the iPhone 16e, poses a significant risk to Qualcomm's revenue. Analysts estimate a potential 35% revenue loss from Apple initially, with further declines as Apple phases out Qualcomm's modems in future models. Barrons

- Licensing Revenue Concerns: Qualcomm's licensing (QTL) revenue fell slightly short of expectations in Q1, and the expiration of a lucrative agreement with Huawei adds uncertainty to this high-margin segment. Analysts have expressed concerns about the sustainability of licensing revenues amid these challenges. Investopedia

- Smartphone Market Saturation: The global smartphone market has shown slower growth, with mid-single-digit unit sales increases in recent years. Qualcomm's heavy reliance on the smartphone market, which accounts for 75% of its chip revenue, makes it vulnerable to this stagnation. damanmarkets.com

- Dependence on Chinese Market: China accounts for 46% of Qualcomm's revenue, exposing the company to geopolitical risks and potential market share losses as Chinese OEMs develop in-house chips and the government pushes to reduce reliance on U.S. technology. Daman Markets

- Legal Uncertainties with Arm: While Qualcomm secured a legal victory affirming its license to use Arm's chip architecture, the jury deadlocked on whether Nuvia, a CPU design firm acquired by Qualcomm, violated its licensing agreement with Arm. This leaves the door open for a retrial in 2025, introducing legal uncertainties. AI Invest

In summary, Qualcomm's strong performance in automotive, IoT, and AI-enabled PCs demonstrates successful diversification efforts. However, challenges such as Apple's transition to in-house modems, licensing revenue uncertainties, and reliance on the Chinese market present risks that could impact future earnings and guidance. Investors should weigh these factors when evaluating Qualcomm's financial outlook.

QCOM Q1 FY2025 Earnings & Revenue

📊 Analyst Sentiment & Ratings

- Consensus Rating: Moderate Buy

- Out of 30 analysts, 15 rate QCOM as a Buy, 14 as Hold, and 1 as Sell. MarketBeat

- Price Targets

- The average 12-month price target is $205.32, suggesting a potential upside of approximately 58% from the current price of $129.72.

- Price targets range from a low of $160 to a high of $270.MarketBeat

📈 Earnings & Revenue Forecasts

- Fiscal Year 2025 (FY25):

- Revenue: Projected at $44.28 billion, up from $38.96 billion in FY24, marking a 13.65% year-over-year increase.

- Earnings Per Share (EPS): Expected to be $11.99, a 33.65% increase from $8.97 in FY24. StockAnalysis

- Fiscal Year 2026 (FY26):

- Revenue: Forecasted at $46.30 billion, a 4.56% year-over-year growth.

- EPS: Anticipated at $12.45, reflecting a 3.88% increase from FY25. StockAnalysis

📉 Areas of Concern

- Licensing Revenue: In Q1 FY2025, Qualcomm's licensing (QTL) revenue was $1.54 billion, slightly below expectations. Given that licensing contributes significantly to Qualcomm's earnings before taxes, this shortfall is notable. Investopedia

- Apple's In-House Modems: Apple's initiative to develop its own modem chips could impact Qualcomm's future revenues, as Apple has been a significant customer for Qualcomm's modem technology. Barron's

In summary, while analysts are optimistic about Qualcomm's growth prospects, particularly in areas like automotive and IoT, they remain cautious due to potential challenges in licensing revenues and the evolving relationship with major clients like Apple.

🏛️ Recent Congressional Trades in Qualcomm

Over the past 4–6 months, several U.S. lawmakers have disclosed purchases of Qualcomm (NASDAQ: QCOM) stock, indicating a positive sentiment toward the company within Congress.

Notably, there have been no reported sales of QCOM stock by members of Congress during this period. This consistent buying activity across party lines suggests a bipartisan confidence in Qualcomm's performance and prospects.

📊 Overview of Congressional Activity

- Total Trades: 5 purchases, 0 sales

- Estimated Total Value: Up to $75,000 Market Beat, WeBull

These transactions have been disclosed following the STOCK Act, which mandates timely reporting of stock trades by U.S. lawmakers. The bipartisan nature of these investments may reflect a shared optimism about Qualcomm's role in the semiconductor industry and its growth potential.

For real-time updates on congressional trading activity, platforms like Quiver Quantitative and AltIndex provide comprehensive dashboards tracking such disclosures. Investing.com

🧩 Factors at Play for Qualcomm (QCOM) Heading into Earnings

➕ Positives:

- Analyst sentiment: "Moderate Buy" rating, high upside in 12-month price targets (average $205 vs. current ~$130).

- Earnings growth expectations: EPS and revenue forecasted to grow sharply in FY25 (EPS up 30%+ YoY).

- Congressional purchases: Multiple bipartisan buys over the last few months — no sales — signaling institutional/political confidence.

- New growth areas: Expansion into Automotive, IoT, and AI chips is getting more visibility and support from Wall Street.

➖ Negatives:

- Licensing revenue risk: Licensing division (QTL) missed last quarter and remains a soft spot.

- Apple risk: Threat of Apple building its own modems could create negative commentary in forward guidance.

- Valuation: Despite the positive outlook, some investors may argue that a 58% projected upside is "already priced in" given the AI-driven semiconductor rally.

- Macro environment: Broader tech and semiconductor sector volatility (especially after recent mixed results from peers like AMD and Intel) could introduce selling pressure even on decent earnings.

🧠 Putting It Together: What to Expect

- If Qualcomm beats EPS/revenue modestly and gives upbeat guidance ➔ Likely a sharp move up (5–8% possible).

- If Qualcomm beats earnings but warns about licensing (QTL) or Apple modem threats ➔ Mixed reaction (initial spike, then fade, maybe ending ±2% or flat).

- If Qualcomm misses or guides cautiously on overall handset/consumer markets ➔ Sharp drop (5–10% lower is possible given elevated expectations).

Tone of Forward Guidance Will Matter More:

- Positive commentary on AI chips, automotive, and server businesses ➔ investors will likely buy any small dips.

- Negative commentary on handset chips, licensing, or geopolitical risks ➔ investors could sell, even on headline earnings beats.

🎯 Summary:

➡️ Slightly bullish skew heading into earnings based on sentiment, but high volatility expected either way.

➡️ The first 15–30 minutes after the report will likely see wild swings before settling.

➡️ In options pricing, the implied move is usually around ±6–8%, meaning the market is prepared for a big reaction.

Bonus— here’s a clean Visual Scenario Map 🗺️ for QCOM earnings day tomorrow:

📊 Qualcomm (QCOM) Earnings Reaction Map

🧠 Key "Instant Read" Checklist During Earnings Call:

- EPS Beat?

- Revenue Beat?

- Q2 2025 Guidance: Up or Down vs consensus?

- Mentions of AI/Automotive growth?

- Comments about Apple modem risk?

If the first three are positive ➔ very likely a green move 📈 even if there's some concern later.

🛡️ Risk Control Tip:

If you’re planning to trade it:

→ First 15–20 minutes after release = chaos.

→ After the earnings call Q&A session, market usually "chooses" a clear direction.